Dec 11, 2013 6:04:49 PM

In a recent conversation with one of our key Prime Brokerage relationships, we were asked whether or not their client had protection for trade errors. It was their understanding that the error itself wasn't covered but the defense and legal bills typically would be. Please see our exchange below:

Read More

Tags:

Insurance,

Investment Advisor,

Iron Cove Posts,

cost of corrections,

Directors & Officers Liability,

Errors and Omissions,

hedge fund,

Trade error

Tags:

hedge fund insurance,

insurance,

Iron Cove Posts,

brokerage,

Consultants,

directors and officers liability,

Directors & Officers Liability,

D&O,

Form PF,

Iron Cove Partners,

Madison Avenue,

New York City,

Opens Office,

Private Equity,

Professional Liability,

Property & Casualty,

Risk Management

Jun 25, 2011 11:30:01 AM

The Dodd–Frank Wall Street Reform and Consumer Protection Act, is a federal statute signed into law on July 21, 2010. The Act offers many sweeping changes to the financial regulatory environment and affects almost every aspect of the nation’s financial services industry. Under the Act, investment managers/advisers to private equity funds and all private investment funds will have to register as investment advisers with the SEC no later than July 21, 2011. There is a provision that exempts managers of private equity funds with less than $150 million in assets under management from registering. If you do not fall within the exemption, then failing to register would constitute a willful violation of the act.

Read More

Tags:

accredited investor,

Insurance,

insurance,

allocations,

Iron Cove Posts,

Chief Compliance Officer,

Cyber & Privacy Liability,

directors and officers,

Directors & Officers Liability,

Dodd-Frank,

dodd-frank,

Errors and Omissions,

hedge fund,

Management Liability,

Professional Liability,

Property & Casualty,

Reform,

Regulation,

regulation,

SEC,

SEC Investigations

Jun 24, 2011 2:21:31 PM

Article written by Gregory C. Sibilio, Esq.

Vice President

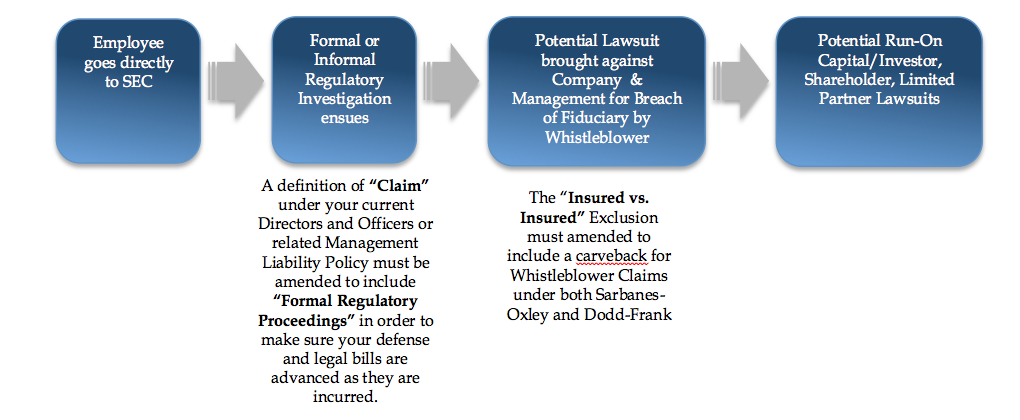

May 16, 2011, The Dodd-Frank Whistleblower Provision has been in the news recently for two separate reasons. The first is that the first major federal court opinion on the provision was ordered on May 4, 2011. The second is that on May 11, House Republicans introduced new legislation to the Dodd-Frank Act at a House Committee on Financial Services subcommittee hearing. This legislation attempts to limit the Whistleblower Provision’s impact by requiring employees to report fraud to their superiors before going to the SEC. The Court ruling and the legislation are similar in the sense that they both involve going through the internal chain of command before going to the SEC. They will be discussed below.

The Whistleblower Provision (Section 922 of the Dodd Frank Act) specifies that a person who provides to the SEC, original information of securities fraud within the company that leads to an enforcement penalty of $1 million or more may be entitled to collect between 10 and 30 percent of the penalties of $1 million or more. The Act prohibits employer retaliation against whistleblowers by employers and would provide for the whistleblower’s immediate reinstatement, as well as double back pay, attorneys’ fees, and other reasonable costs.

Read More

Tags:

hedge fund insurance,

insurance,

Asset Management,

Iron Cove Posts,

Directors & Officers Liability,

Dodd Frank,

hedge fund,

Iron Cove Partners,

regulation,

SEC