The Whistleblower Provision (Section 922 of the Dodd Frank Act) specifies that a person who provides to the SEC, original information of securities fraud within the company that leads to an enforcement penalty of $1 million or more may be entitled to collect between 10 and 30 percent of the penalties of $1 million or more. The Act prohibits employer retaliation against whistleblowers by employers and would provide for the whistleblower’s immediate reinstatement, as well as double back pay, attorneys’ fees, and other reasonable costs.

In the recent case, Egan v. TradingScreen Inc., the Southern District of New York ruled that the Plaintiff, Patrick Egan, was not protected under Dodd-Frank’s Whistleblower provision where he reported a potential securities fraud violation to his company President, who then informed the directors to conduct an investigation. Egan was subsequently fired, and the court ruled that he could not seek protection under the Dodd-Frank Act because he did not go directly to the SEC. The Court did grant Egan the ability to amend his complaint and potentially argue that his cooperation with the law firm investigating the action was tantamount to providing truthful information to a law enforcement officer, but the precedent has been set insofar as the whistleblower needs to go directly to the SEC to be granted protection.

This leads to the piece of legislation that Republicans introduced on May 11th. The legislation would call for a whistleblower to report the law internally before going to the SEC, just as Patrick Egan did. The argument for this law would be to first put the Employer on notice of a potential violation. This would allow the Employer to investigate and remedy the problem on its own without having to go through the cost and potential public embarrassment of a formal SEC investigation. The rule is meant to protect investors. Incurring the unnecessary costs of an SEC investigation would be contrary to the initial intent of the provision.

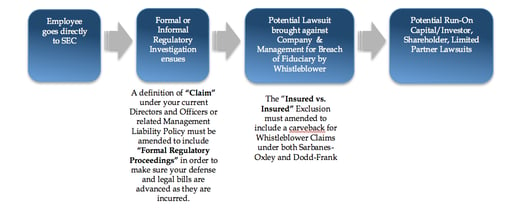

According to the Dodd-Frank Act as currently written, an employee looking to report a potential violation of securities laws must go directly to the SEC. Below is the potential chain of events which could take place and the related implications to your Management Liability Insurance Program should a whistleblower go directly to the SEC.

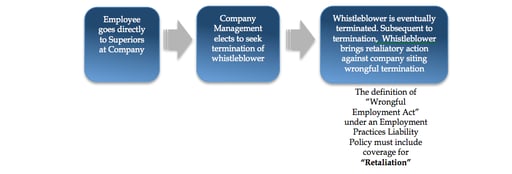

As previously stated, House Republicans introduced new legislation at a House Committee on Financial Services subcommittee hearing which attempts to limit the Whistleblower Provision’s impact by requiring employees to report fraud to their superiors before going to the SEC. Below is the potential chain of events which could take place and the related implications to your Management Liability (inclusive of Employment Practices Liability Coverage) Insurance Program should a whistleblower go directly to their respective superiors.

If the Whistleblower Provision is not amended and is strictly interpreted, it is safe to say that there will be increased litigation from whistleblowers. It is imperative to review your current management liability insurance policies to make sure they provide the appropriate coverage.

This article is written by Gregory C. Sibilio, Esq. a Vice President in the Financial Services Division of Iron Cove Partners, LLC a Division of the Whitmore Group, Ltd. (“ICWG”). ICWG is a market leader in providing risk management and insurance solutions to companies engaged in the financial services arena. Should you have any questions or comments, please do not hesitate to contact Mr. Sibilio @ 516-267-6177 or via email @ gregs@ironcoveins.com. To follow Iron Cove Partners, LLC on Twitter CLICK HERE.

The materials posted here are for informational purposes only and not for the purpose of providing legal advice. You should contact your attorney to obtain advice with respect to any particular issue or problem. Use of and access to this Web site does not create an attorney-client relationship between.

Tags: hedge fund insurance, insurance, Asset Management, Iron Cove Posts, Directors & Officers Liability, Dodd Frank, hedge fund, Iron Cove Partners, regulation, SEC

Comments