Jun 25, 2011 11:30:01 AM

The Dodd–Frank Wall Street Reform and Consumer Protection Act, is a federal statute signed into law on July 21, 2010. The Act offers many sweeping changes to the financial regulatory environment and affects almost every aspect of the nation’s financial services industry. Under the Act, investment managers/advisers to private equity funds and all private investment funds will have to register as investment advisers with the SEC no later than July 21, 2011. There is a provision that exempts managers of private equity funds with less than $150 million in assets under management from registering. If you do not fall within the exemption, then failing to register would constitute a willful violation of the act.

Read More

Tags:

accredited investor,

Insurance,

insurance,

allocations,

Iron Cove Posts,

Chief Compliance Officer,

Cyber & Privacy Liability,

directors and officers,

Directors & Officers Liability,

Dodd-Frank,

dodd-frank,

Errors and Omissions,

hedge fund,

Management Liability,

Professional Liability,

Property & Casualty,

Reform,

Regulation,

regulation,

SEC,

SEC Investigations

Jun 24, 2011 2:21:31 PM

Article written by Gregory C. Sibilio, Esq.

Vice President

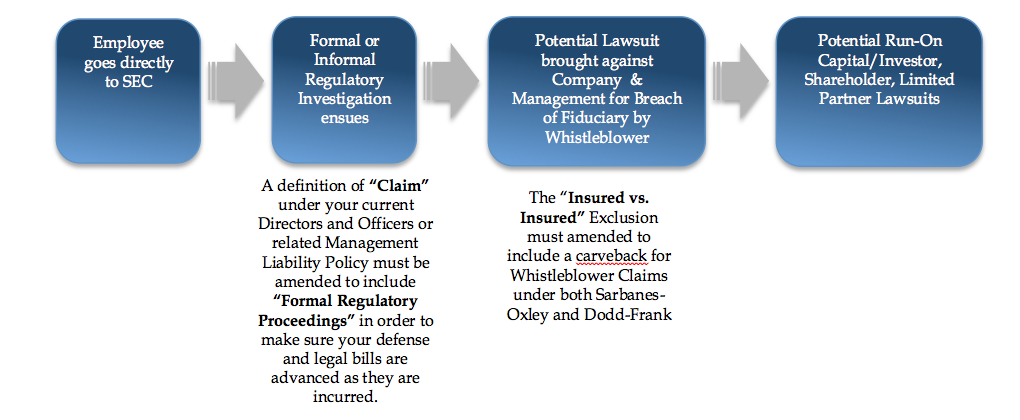

May 16, 2011, The Dodd-Frank Whistleblower Provision has been in the news recently for two separate reasons. The first is that the first major federal court opinion on the provision was ordered on May 4, 2011. The second is that on May 11, House Republicans introduced new legislation to the Dodd-Frank Act at a House Committee on Financial Services subcommittee hearing. This legislation attempts to limit the Whistleblower Provision’s impact by requiring employees to report fraud to their superiors before going to the SEC. The Court ruling and the legislation are similar in the sense that they both involve going through the internal chain of command before going to the SEC. They will be discussed below.

The Whistleblower Provision (Section 922 of the Dodd Frank Act) specifies that a person who provides to the SEC, original information of securities fraud within the company that leads to an enforcement penalty of $1 million or more may be entitled to collect between 10 and 30 percent of the penalties of $1 million or more. The Act prohibits employer retaliation against whistleblowers by employers and would provide for the whistleblower’s immediate reinstatement, as well as double back pay, attorneys’ fees, and other reasonable costs.

Read More

Tags:

hedge fund insurance,

insurance,

Asset Management,

Iron Cove Posts,

Directors & Officers Liability,

Dodd Frank,

hedge fund,

Iron Cove Partners,

regulation,

SEC

Sep 12, 2010 10:37:08 AM

We had to know that this was coming. Due diligence guidelines and responsibilities of Advisers and Funds that make investments in other funds have been increasing steadily over the past 24 months. I don't think this is any surprise and it will be interesting to see what (if any) regulations or rules are passed as a result. See 9-12-10 Wall Street Journal article for more detail.

Read More

Tags:

allocations,

due diligence,

fund of funds,

Hedge Fund Regulation,

hedge funds,

investors,

SEC

Aug 16, 2010 8:50:59 AM

Dodd Rule amends definition of accredited investor. Article by HF Law Report states individuals can no longer use home to calculate net worth.

Read More

Tags:

accredited investor,

Dodd Frank Act,

Hedge Fund Regulation,

hedge funds,

regulation,

SEC