Jun 24, 2011 2:21:31 PM

Article written by Gregory C. Sibilio, Esq.

Vice President

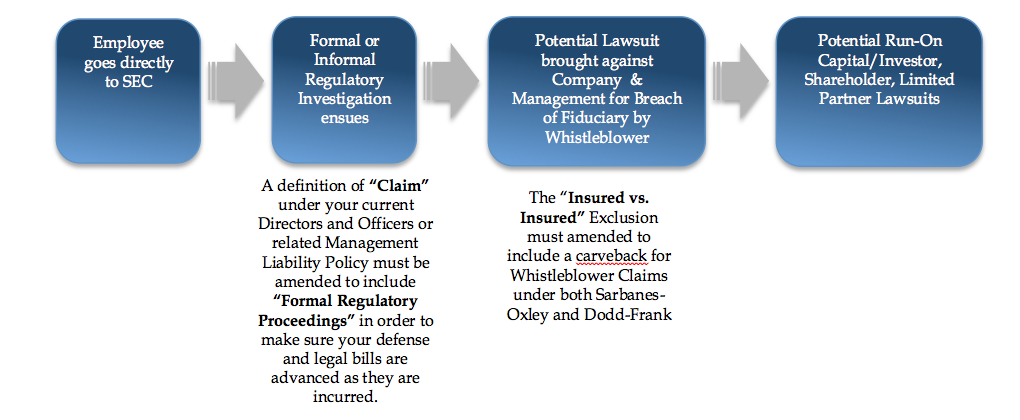

May 16, 2011, The Dodd-Frank Whistleblower Provision has been in the news recently for two separate reasons. The first is that the first major federal court opinion on the provision was ordered on May 4, 2011. The second is that on May 11, House Republicans introduced new legislation to the Dodd-Frank Act at a House Committee on Financial Services subcommittee hearing. This legislation attempts to limit the Whistleblower Provision’s impact by requiring employees to report fraud to their superiors before going to the SEC. The Court ruling and the legislation are similar in the sense that they both involve going through the internal chain of command before going to the SEC. They will be discussed below.

The Whistleblower Provision (Section 922 of the Dodd Frank Act) specifies that a person who provides to the SEC, original information of securities fraud within the company that leads to an enforcement penalty of $1 million or more may be entitled to collect between 10 and 30 percent of the penalties of $1 million or more. The Act prohibits employer retaliation against whistleblowers by employers and would provide for the whistleblower’s immediate reinstatement, as well as double back pay, attorneys’ fees, and other reasonable costs.