Tags: 2011, insurance, Iron Cove Posts, brokerage, Coverage, directors and officers liability, employment practices, limit of liability, limits, Lou D'Agostino, not for profit, outside directors, premium, private company, regulatory claims, tower watson

Lou D'Agostino named IT/Social Media Director for NFL Alumni Long Island Chapter

Tags: insurance, Iron Cove Posts, Business, Company News, Iron Cove, Iron Cove Partners, Lou D'Agostino, New York Jets, NFL, NFL Alumni, NFL Alumni Long Island

Solution to Risk Management Concerns

After speaking with 100's of COO, CFO's & CCO's of Asset Management Firms, their biggest gripe is the amount of time spent on the risk management function. From completing long-form applications to organizing droves of insurance related documentation, dealing with insurance has been painstaking and does have a direct impact to the firm.

"I would be better served spending more time on compliance and accounting then I would be trying to organize and compartmentalize all of our insurance documents" said one CFO of a $2billion NYC based Hedge Fund.

Given that many CFO's wear a variety of hats for their firm, dealing with insurance and risk management can truly take away from other and more important day-to-day functions:

- Accounting;

- Compliance;

- Portfolio Management; &

- Other

Time away from more important day-to-day functions effect bottom line profitability and long-term sustainability of any asset management firm.

We have found that our suite of products and services helps our clients focus on what is most important and takes unnecessary work off of their desks.

Below I have included a link to our 24/7 client portal demo. This demo illustrates how our online portal can help you organize and manage all of your firms insurance related documentation as well as keep abreast of all the firms insurance policies.

Tags: insurance, agency, asset managers, Iron Cove Posts, brokerage, directors and officers liability, Errors and Omissions, hedge fund, largest, Lou D'Agostino, louis d'agostino, Private Equity, property & casualty

Dodd-Frank Requires the need to hire a Chief Compliance Officer: Is the CCO Adequately Protected??

The Dodd–Frank Wall Street Reform and Consumer Protection Act, is a federal statute signed into law on July 21, 2010. The Act offers many sweeping changes to the financial regulatory environment and affects almost every aspect of the nation’s financial services industry. Under the Act, investment managers/advisers to private equity funds and all private investment funds will have to register as investment advisers with the SEC no later than July 21, 2011. There is a provision that exempts managers of private equity funds with less than $150 million in assets under management from registering. If you do not fall within the exemption, then failing to register would constitute a willful violation of the act.

Tags: accredited investor, Insurance, insurance, allocations, Iron Cove Posts, Chief Compliance Officer, Cyber & Privacy Liability, directors and officers, Directors & Officers Liability, Dodd-Frank, dodd-frank, Errors and Omissions, hedge fund, Management Liability, Professional Liability, Property & Casualty, Reform, Regulation, regulation, SEC, SEC Investigations

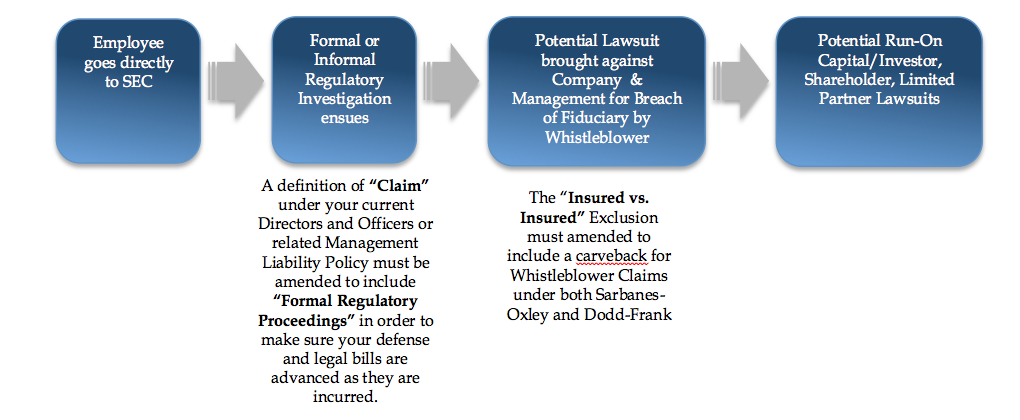

How The Dodd-Frank Whistleblower Provision Could Affect Your Management Liability Insurance

The Whistleblower Provision (Section 922 of the Dodd Frank Act) specifies that a person who provides to the SEC, original information of securities fraud within the company that leads to an enforcement penalty of $1 million or more may be entitled to collect between 10 and 30 percent of the penalties of $1 million or more. The Act prohibits employer retaliation against whistleblowers by employers and would provide for the whistleblower’s immediate reinstatement, as well as double back pay, attorneys’ fees, and other reasonable costs.

Tags: hedge fund insurance, insurance, Asset Management, Iron Cove Posts, Directors & Officers Liability, Dodd Frank, hedge fund, Iron Cove Partners, regulation, SEC

Online Social Networking, A Brave New World of Liability for Employers

Employers can be held liable for the activities of employees under the common law doctrine of agency – respondeat superior. This doctrine states that the superior (or “principal”) is held responsible for the acts of its subordinate (or “agent”). A company (the “principal” in this case) can be held liable for the actions of its employees and others deemed agents of the company, even if the agents are acting independently. This is called “vicarious liability.”

Tags: insurance, Internet Professional Liability, Agency (law), Brave New World, Company, discrimination, Employment, Insurance Industry News, Law, Legal liability, Media Liability, media liability, social media, Social Media Liability, social networking, Swett & Crawford, United States